We live in the third decade of the 21st century, an era that has changed life in different ways. To shape every day into a new experience is a challenge we all face, as the world around us keeps updating itself with the latest technologies for higher efficiency. Proper resource allocation and management is one thing that needs expert handling, and this can only be organized by the groups with authority to take action. Finance is one area that needs timely interventions in order to make a positive difference in the structure we have built over the years. Products and services are being developed in the industry to boost the system’s approach to the growing needs.

FinTech is one innovation that can propel the industry to new heights, and it has been indeed creating massive waves in the market with its multiple applications. People are yet to be acquainted with the concept of this technology, though it has been in the game for more than a decade now. It has only been upgrading the current structure with more facets. Let us look at more details of FinTech to better understand the business functions of every domain within the industry.

What is Fintech

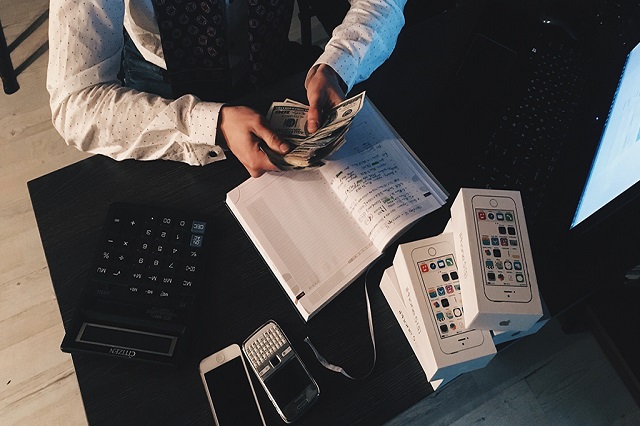

Finance and technology are combined in this term, with the concepts blending with each other to build businesses through the technologies that exist in the market. Services and processes in the financial sector are enhanced and automated by the applications developed by the organizations working in this circle. The industry has been relentlessly growing over the years, building a space for the whole process to be executed through multiple stages.

As ‘FinTech’ thrives as a term, its applications execute huge prospects in the vast market. Insurance, investment options, loans, and cryptocurrency are just a few of the sectors working under FinTech. Traditional banks and institutions are adopting this technology to invest in the right startups and companies to attract more digitally-informed customers. Such technologies are crucial to keeping the financial sector and its various offerings relevant.

Working of Fintech

Most of us may look at FinTech as a new addition to the financial sector, but it is an industry that has been around for a long time and keeps evolving. Technology has become a part of the financial world through multiple links, and one of the first steps to fast transactions was the launch of credit cards and electronic payments. Every application and project will have a different set of regulations and working structures, depending on the advances the companies have made in the process.

Navigating complex technologies can be hard if the user is relatively new to the concepts. We need to keep pushing our boundaries in order to learn what would favor our financial position. FinTech has expanded massively over the years through banking, cryptocurrency, investment, machine learning, lending, payments, insurance, and trading. Several trends keep popping up in the market to help build the power of the industry.